One of the interesting topics which came up this week in the Dividend Kings chat was the volatility in “cash equivalent” ETFs such as the PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT).

Over the course of the last two weeks, MINT’s price and NAV have “fallen off a cliff” so to speak, with shares of the fund dropping from a high of $101.95 to the current $99.79, wiping out close to a year’s worth of dividends.

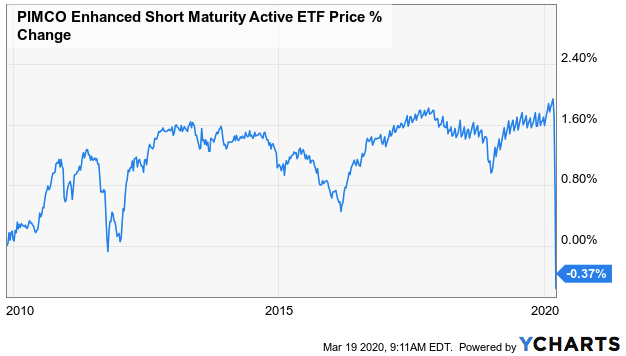

Drawdowns of this magnitude are not unprecedented. As we can see, significant drops in NAV occurred in 2012, 2016, and 2018. Perhaps what makes the current drop feel so different is the rapidity with which it occurred.

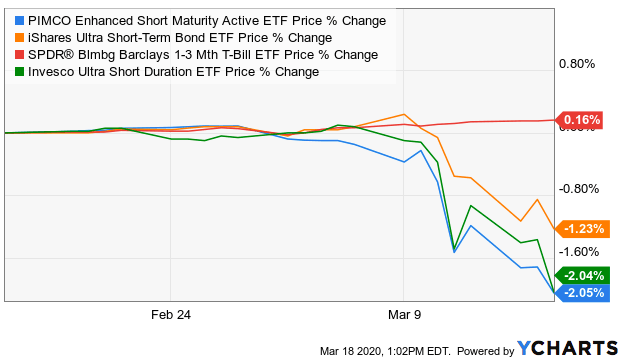

Other ultrashort duration ETFs have also experienced drops in NAV, to varying degrees:

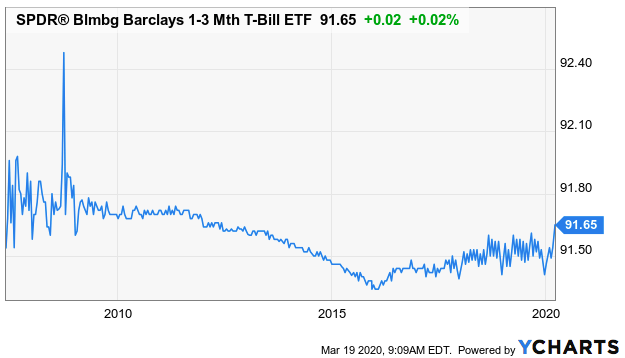

The Invesco Ultra Short Duration ETF (GSY) dropped a similar magnitude as MINT while the iShares Ultra Short-Term Bond ETF (ICSH) had a milder drawdown. The lone standout which managed to retain its value is the SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL). As we will see, although all of these ETFs are billed as ultrashort duration “cash equivalents,” their portfolio compositions vary greatly, leading to the divergence in performance.

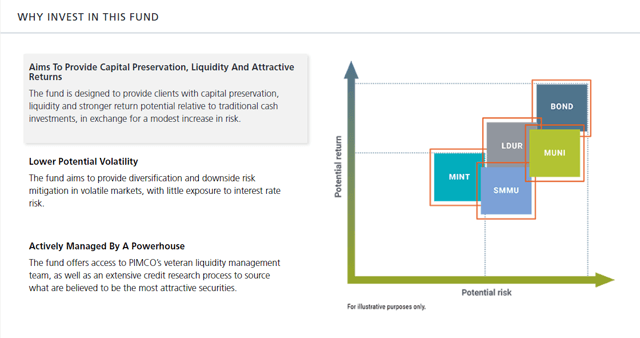

Why have investors embraced “cash equivalent” ETFs in the first place? Largely because of a search for yield. With the elimination of trading commissions across the industry, most brokerages now source the majority of their earnings off uninvested cash balances, which pay little to no interest. The “cash equivalent” ETFs were advertised as allowing investors to earn a reasonable yield with limited risk, as seen in this graphic from MINT:

Undoubtedly, many investors saw the appeal in earning a greater yield than might be available in a savings account, while keeping balances in brokerage accounts, where shares could be quickly sold to provide liquidity when they wanted to shift funds into equities. Unfortunately for many, this has not worked quite as expected, and investors are now faced with the conundrum of whether to lock in the slight capital losses or to ride it out and wait for prices to recover while potentially missing out on buying opportunities. No one knows if, or when a recovery may occur, or if further losses are in store. If history is a guide, it will be at least a few months before this all blows over. Temporary illiquidity and loss of capital is not a good look for an investment that is supposed to provide liquidity and preserve capital.

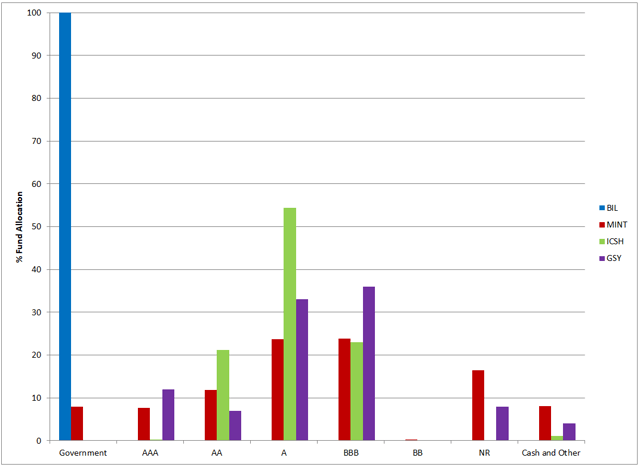

Returning to the diverging performance between the four ETFs (BIL, MINT, ICSH, GSY), by looking at the holdings in each ETF portfolio, we can see performance seems correlated to credit quality. BIL, which holds 100% Treasury Bills, had no drawdown, as Treasuries are essentially risk-free.

Of the remaining three ETFs, ICSH’s portfolio has a slightly higher average credit rating, centered around “A” (S&P), while MINT and GSY hover somewhere between “A” and “BBB” with some unrated credits. As expected with a higher credit quality, ISCH had a milder drawdown than MINT or GSY.

Typically, the tradeoff for higher credit quality is a lower yield, and we can see that this is certainly the case here, with BIL yielding about 0.6% less than the other ETFs. ICSH, which has a slightly higher credit quality than MINT and GSY, similarly yields nominally less.

| TTM Yield | SEC yield | |

| BIL | 1.89 | 1.22 |

| MINT | 2.55 | 1.87 |

| ICSH | 2.49 | 1.85 |

| GSY | 2.68 | 1.96 |

Is the higher yield worth the greater risk? Based on what we’ve seen so far, the risk to reward ratio doesn’t seem that compelling – for an extra ~0.5% yield there is a chance of 1-2% loss. In addition, sticking with Treasuries may actually have a slight negative beta in times of crisis, as investors pile into safe havens. This is seen in BIL’s brief spikes during the Great Recession and an increase in NAV during this last month.

I should warn however, that BIL is not necessarily the best place to park cash either. After all, the ETF paid no dividends from 2009-2016 (aside from a 0.2 cent distribution in 2011), resulting in a loss of ~40 bps over 6 years, courtesy of 0% interest rates (which, incidentally, we are back to, so expect dividends to keep decreasing).

Ironically, the optimal place to deploy unused cash may very well end up being the humble savings account. As of the time of this writing, the highest savings account rates were approximately 1.8% APY, not that far off BIL’s 1.85% TTM yield, and far higher than BIL’s 1.27% annualized forward yield based on the most recent dividend. (Forward yields for MINT, ICSH, and GSY are 2.05%, 1.96%, and 2.24% respectively, based on most recent dividend, and likely to keep dropping) Of course rates are subject to change, but savings account rates are likely to stay above zero longer than Treasuries, as banks have exposure to higher yielding loans. Meanwhile, balances are guaranteed by the FDIC (up to a limit), so there is no risk of loss of capital unlike the short term corporate bond ETFs. While it may be more cumbersome to move funds back and forth between brokerage and savings accounts, this may actually prove to be a blessing in disguise. Buying opportunities very rarely disappear within a matter of days, and more often develop over a time frame of weeks to months. By restricting availability of funds for purchase, investors are more likely to reduce impulsive buying. One possible strategy might be to maintain a 1-2% “working capital” cash balance in brokerage accounts while keeping the remaining cash in savings, and only transferring additional cash once the balance is exhausted.

As the saying goes, “Cash is King.” Many investors in “cash equivalent” ETFs have had to learn that lesson the hard way. Although losses have not been catastrophic, performance has certainly been suboptimal, and investors need to take a hard look at what exactly they are putting their funds into, and whether it meets their risk tolerance.