We're Value Investors

We love high quality stocks. We aren’t speculators. Our value oriented principles inspire us to invest in many of the most profitable companies that the market has to offer.

We follow hundreds of the best-in-breed companies across all sectors and industries to ensure that our subscribers aren’t missing out on attractive dividend growth opportunities.

Our value oriented focus on the underlying fundamentals is meant to identify attractive margins of safety in an attempt to protect investor capital.

Our disciplined analysis of company fundamentals should provide peace of mind with regard to safe dividend yields as well as sustainable dividend growth opportunities.

The Dividend Kings

The Dividend Kings are a collection of income oriented analysts and investors who share a deep passion for value investing principles and the slow and steady wealth generation potential that comes along with dividend growth investing.

Compound interest is our best friend. With decades of experience under our belts in the markets, we’ve seen the power of accumulating high quality dividend growth stocks that provide regular and reliable dividend growth, first hand.

The fundamental growth that blue chip companies tend to provide over the long-term, combined with dividend reinvestment, creates a scenario where wealth compounds exponentially over the long-term.

Time is the most valuable resource that we all have as investors. Our proven strategies require patience, but over the long haul, we don’t believe that there is a better strategy to pursue in terms of generating alpha than the one we provide.

Our focus is not only on safe dividend yields and reliable dividend growth, but also the highest quality companies with the most attractive underlying fundamentals. By marrying value investing with income oriented priorities we’ve numerous portfolios and sound investing strategies for a variety of investors in an attempt to meet their long-term financial needs.

MEET THE KINGS

We’ve amassed an expert team of disciplined, conservative, income oriented investors. Our analysts have decades of experience monitoring hundreds of dividend growth stocks. You can rest assured that we remain dedicated to not only deciphering dividend safety so that investors can sleep well at night knowing that their income is both safe and likely to post reliable growth, but also highlighting the best value opportunities we see across the spectrum of high quality income oriented companies that we follow.

Brad Thomas

Brad Thomas is a research analyst and he currently writes weekly for Forbes and Seeking Alpha where he maintains research on many publicly-listed REITs. In addition, Thomas is the Editor of the Forbes Real Estate Investor, a monthly subscriber-based newsletter. Thomas has also been featured in Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional investor, Globestreet, CNN, Newsman, and Fox. His was the #1 contribution analyst on Seeking Alpha in 2014, 2015, 2016, and 2017 (based upon total page views). Thomas has co-authored the book, The Intelligent REIT Investor, and is the author of The Trump Factor: Unlocking The Secrets Behind The Trump Empire. Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful children.

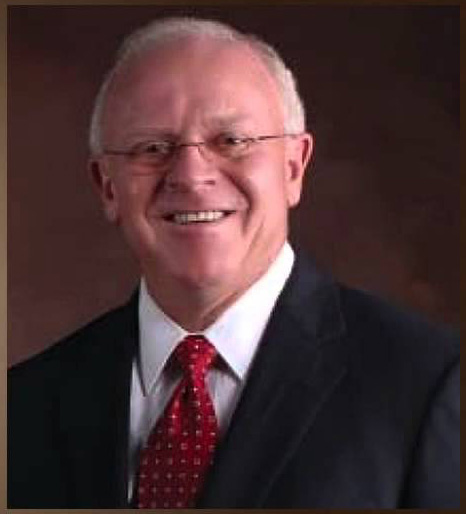

Chuck Carnevale

Charles (Chuck) Carnevale is the creator of FAST Graphs. Chuck is also the co-founder of an investment management firm. He has been working in the securities industry since 1970. He has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Direction of a major AMEX list company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm. Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

Adam Galas

Adam Galas is a 33-year old analyst who has been passionate about investing in the stock market since the age of 9. Over the last 24 years, Adam has learned, the hard way, what works and what doesn’t Over the last six years as a professional analyst/investment writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group, Adam has determined that value based, blue-chip dividend growth investing is the best way for most people to exponentially grow their income and wealth over time. Adam is a huge fan of the old adage, give a man a fish, and you’ll feed him for a day; teach a man to fish, and you’ll feed him for an entire lifetime. His goal is to not just point out great, actionable investing ideas, but to also educate clients about the proper way to think about income investing to help to set them up for success over the long-term.

Justin Law

Justin Law is the curator of the Dividend Champions list, a monthly publication of companies with a history of consistently increasing their dividends. His primary investing focus is in deep value and dividend paying stocks, but he is constantly exploring alternative strategies. Justin has a Ph.D in Chemistry from Rice University and has been investing for over 15 years.

Nicholas Ward

Nicholas Ward is a research analyst who currently writes for Seeking Alpha, The Dividend Kings, iREIT, and the Forbes Real Estate Investor. Prior to joining The Dividend Kings, Nicholas was the Founder and Editor-in-Chief of The Dividend Growth Club, as well as the Income Minded Millennial. Nicholas has also contributed to Sure Dividend, Investing Daily, and The Street, where he covered stocks in Jim Cramer’s Action Alerts PLUS Portfolio. Nicholas holds a Bachelor of the Arts from the University of Virginia where he studied English and Studio Art. Prior to transitioning into the financial industry, Nicholas managed a vineyard in the foothills of the Blue Ridge Mountains.