You may have noticed that over the last few years, companies have started disclosing more information about their Environmental, Social, and Governance metrics. ESG investing is a recent trend gaining traction amongst investors. According to a report published by the Global Sustainable Investment Alliance in 2018, $12T in US assets under management utilized some form of sustainability screening criteria, representing a quarter of all assets under management, and continues to grow rapidly.

ESG is a slightly different take on ethical investing compared to the Socially Responsible Investing trend which emerged in the ‘70s. SRI focused on what industries investors chose to support and typically utilized exclusionary filters (such as excluding investments in tobacco, alcohol, weapons manufacturers, or other “sin stocks”). ESG on the other hand focuses more on how companies produce shareholder value by looking at environmental impact, company culture, and management’s incentives and relations to stakeholders.

Given the relatively recent rise of ESG, there is very little standardization with regards to what and how metrics are reported. There are currently no regulations requiring disclosure of ESG related topics. The primary sources for ESG information are company sustainability reports and various government and NGO data collection initiatives such as the Global Reporting Initiative. Governance information may be found in proxy materials available from the SEC. A number of financial research firms have started providing ESG scoring services, notably Sustainalytics and MSCI Research, but methodology is often proprietary and there is little consensus on how to evaluate ESG metrics.

Let’s take a look at each of the three components of ESG –what are some relevant metrics and how might this help investors assess a potential investment.

Environmental

The environmental component of ESG looks at how a company utilizes resources and its impact on the environment.

Common metrics: Greenhouse gas/volatile organic compound emissions, spills and fines, water use, (renewable) energy use, waste production/disposal.

Why it’s important: Companies which score higher on an environmental basis tend to be more efficient at using resources. This may result in higher margins, as the costs of production may be lower. Better environmental safety may also mean lower risk of fines or penalties.

Social

The social component of ESG considers how a company treats its employees, suppliers and customers. Safety and diversity are also considered, as well as litigation

Common metrics: Total recordable incident rate (per 100 full time employees), part-time vs full-time employees, percent female/minority employees/management.

Why it’s important: Healthy, happy employees tend to work better and are less likely to leave for other companies, reducing churn and building a skilled, experienced workforce. Diversity within the workforce promotes differing views and ideas which may help the company develop new products or strategies to operate more efficiently.

Governance

The governance aspect of ESG primarily considers the board of directors and upper management of a company. Key topics include transparency in management compensation and what metrics bonuses are tied to; board composition and independence of directors; corporate structure, including dual class shares or controlling shareholders; communication with shareholders and compliance with SEC and other regulatory authorities.

Sample Analysis

As an example, let’s take a look at the sustainability reports of two Oil and Gas E&Ps, EOG Resources (EOG) and Diamondback Energy (FANG). These can be found on the corporate investor relations websites under the “Sustainability” section.

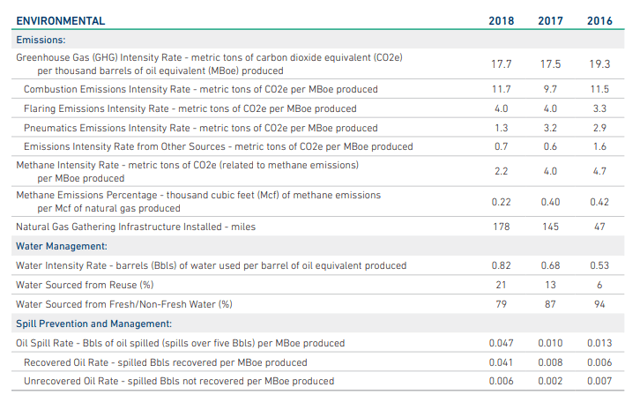

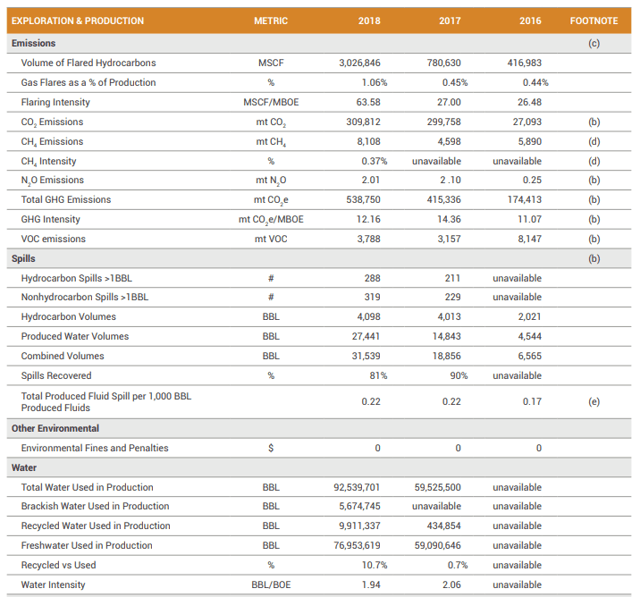

As you can see, even for two similar companies in the same industry, reported metrics can vary by quite a bit and it can be difficult to directly compare numbers. The most directly comparable metrics include: GHG Intensity Rate (17.7 mt CO2e/MBOE for EOG vs 12.16 mt CO2e/MBOE for FANG); water intensity (0.82 BBL/BOE for EOG vs 1.94 BBL/BOE for FANG); recycled water percentage (21% for EOG vs 10.7% for FANG).

Looking at the numbers, we might conclude that EOG produces more greenhouse gases per barrel of oil produced, but uses much less water compared to Diamondback.

But beyond the immediate numbers, it is also instructive to look at trends, and the goals and actions the companies are taking. For example, in its report, EOG highlights expanding use of electric frac spreads to reduce combustion emissions, and retrofitting pneumatic controllers to reduce methane emissions.

Oil may be bad for the environment, and an investor operating under SRI principles might exclude oil producers from their investment portfolio, but an ESG investor might consider that oil will remain a critical part of the energy landscape for the foreseeable future and choose to invest in companies which are able to produce oil in the most environmentally friendly manner.

Exploring the social aspects of the sustainability report, we can see that EOG has 29.5% women and 23.3% minorities, compared to 30% women and 30% minorities at Diamondback. Total reportable incident rates were 0.87 for EOG vs 0.35 for Diamondback. Lost time incident rates were 0.25 at EOG vs 0.16 at Diamondback. This suggests employee composition is similar between the two companies, but that Diamondback may have a slightly safer work environment given the lower incident rates.

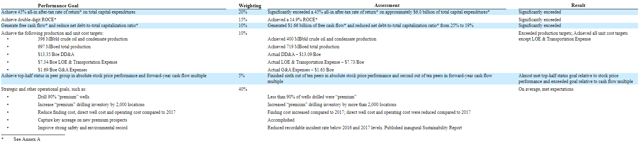

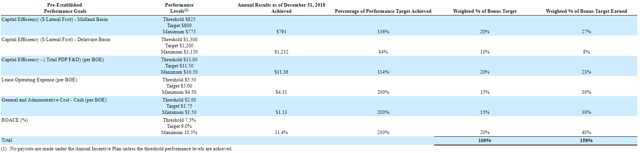

Turning to governance, we can explore how management is incentivized by looking at proxy statements (available from the SEC). Here are the sections related to performance goals.

EOG:

Diamondback:

We can see some interesting differences in what each company prioritizes. Diamondback is highly focused on capital efficiency and reducing lease operating expenses and G&A costs. EOG highly weights acquiring and drilling “premium” wells (which it defines as >30% after tax rate of return at $40 oil / $2.50 natural gas). EOG also includes performance targets for production, free cash flow, debt reduction, and safety and environmental record – items which are not found in Diamondback’s performance goals.

Conclusion

Exploring the ESG aspects of a potential investment can provide additional insight into how a company operates and how its goals and targets align with those of investors. Companies with good ESG metrics may operate more efficiently and be less exposed to risks. Unfortunately, at this point, analysis of the ESG aspects of companies is very much an art rather than science, as there are no reporting standards, relevant metrics vary between industries, and pertinent information may often be unquantifiable. Still, ESG may be an aspect of a company worth exploring, if only to make you, the investor, more comfortable with what you are buying.